Mortgage Calculator How Much Will I Pay – The world’s largest online directory of resources and tools for startups and products is best viewed at ProductHunt History.

Loan calculator tools are computer tools that allow users to calculate the financial benefits of changing one or more variables in a mortgage loan agreement. Consumers use loan calculators to calculate monthly payments, while lenders use them to assess a home loan applicant’s financial eligibility. Although the Consumer Financial Protection Bureau has developed its own loan calculator for the public, these tools are often found on websites for profit. This makes it a bit difficult to find the top tools in the field that will provide you with real information and help without a technical support system.

Mortgage Calculator How Much Will I Pay

Luckily, we’ve got you covered for that respect. We have got for you the best list of 20 loan calculators that will help you when writing your loan plan.

Free Mortgage Split Home Loan Repayments Calculator

The mortgage calculator on Zillow.com offers a variety of mortgage options, including estimating your mortgage, including taxes and insurance. Simply enter the home value, including your down payment, and loan information to calculate your mortgage payment, amortization, and interest rates, and more.

USMortgage’s home loan calculator measures not only your monthly payment, but important “extras” such as home insurance, property taxes, and home equity costs.

Trulia walks you through mortgage loan estimates for non-traditional mortgage lenders such as veterans loans, FHA 30- and 15-year mortgages, and adjustable rate mortgages. It also has some charms that you may not have expected. For example, Trulia’s calculator asks for your zip code to determine how local taxes affect your mortgage (which affects both the monthly and total mortgage payments).

The Dave Ramsey.com Mortgage Calculator is very user-friendly, and it can calculate your monthly mortgage payments and total mortgage payments. Just enter the value of your property, the amount of your down payment, the type of loan, and the interest rate.

Excel Amortization Schedule

The Veterans United Mortgage Calculator, which is designed specifically for current and former members of the United States military, guides VA borrowers through the entire process of determining a home loan. . It works on your mortgage payment estimate with ease and helps you calculate taxes, home insurance, and veterans loans.

The FHA down payment calculator includes the FHA insurance premium, monthly FHA insurance, property taxes, and home insurance to create the appropriate FHA amount.

Karl created his loan calculator in 1990. It was not as fancy and elegant as today’s loan calculator. But it can also be used for other purposes. It helps you to calculate how much extra money will reduce your debt, how quickly you will pay it off, and how much money you will save, for example.

Understanding your home loan with a home loan calculator will help you shape the future. “Mortgage Pal – Calculator” includes two functions in one app: a mortgage loan calculator and a mortgage payment calculator. Check out the latest mortgage rates and trends. You can use their loan calculator tool to calculate all of your loan and mortgage costs, including PMI, taxes, and other mortgage costs.

Yen Loan Calculator For Buying A House In Japan

The Loan Calculator.net tool is a program that uses six input numbers and solves for two unknowns, such as the loan amount and the monthly payment. This solves the most important problem with short hours by providing short hours based on given conditions. Because the amount of the loan, the interest rate, and other changes in the loan company can change, it provides a short period of time based on the true value of the difference.

Rocket Mortgage is one of the most popular online mortgage lenders in the United States. The lender offers a variety of purchase and repayment options, including a flexible product called “YOURgage,” which allows borrowers to choose between eight and 29 years for the term of their loans, including cash back. Quicken Loans, the parent company of Rocket Mortgage, was founded in 1985 by Dan Gilbert, who still serves as CEO. Quicken Loans rose to prominence in recent years as it acquired the technology that allowed customers to apply for loans online from Rocket Mortgage, which was renamed Quicken Loans in 2021.

This C++ command-line software of Mortgage-Calculator is an accurate calculator for calculating monthly, annual, and total repayments at fixed rates. The tool uses the same exact logic as the previous loan calculator, rounded to the nearest. The application is quick and easy to use, and you can find your actual payment in less than 30 seconds!

Finance Calculator Ultimate is a stable and easy-to-use loan calculator out there that runs on Windows XP/VISTA/7/8. Financial professionals, fund managers, and experienced investors are the target audience for the current offering. You can print and paste the report into any Windows/Office compatible text editor, in addition to the ergonomic report printing capability.

Georges Excel Mortgage Loan Calculator V3.1

This Loan Payment Calculator tool from CalculatorSoup calculates payments, present value, future value, interest, and term for a loan.

The math behind a mortgage is complicated, but Bankrate’s Mortgage Calculator makes it simple and straightforward. Determining your monthly home payment as part of your housing budget is important because it will be your largest expense. Bankrate’s Mortgage Calculator lets you estimate your monthly mortgage payments while you’re hunting for a mortgage or refinance.

Other financial concerns, such as down payments and income statements to easily finance your new home, should be kept in mind in addition to setting your monthly payments. , which is where the SmartAsset loan calculator can help.

Calculating your monthly mortgage payment is an important step in determining how much you can afford. This monthly payment will cover most of your living expenses. When you buy a home or refinance, you can use NerdWallet’s mortgage calculator to estimate your monthly payments.

Free Online Mortgage Calculator

Mortgages are some of the most important financial commitments you will ever make. And, with so many possibilities, figuring out exactly how much they will cost you can be difficult. The loan calculator at MoneyHelper can help you. It will give you a simple, rough picture of the monthly payments you will get for the new loan, interest only, and your mortgage if the interest rate increases.

The bank is only a debt instrument with the guarantee of the property received, and the mortgage fee is calculated in the same way as the income in an annuity; use CalculateStuff’s easy loan calculator.

A mortgage is sometimes required when buying a home, but understanding what you’re paying for — and what you can afford — can be difficult. Borrowers can use a loan calculator to estimate their monthly loan payments based on the purchase price, payments, interest, and other monthly costs. To estimate your monthly income and interest on a new home loan, use Forbes Advisor’s mortgage calculator.

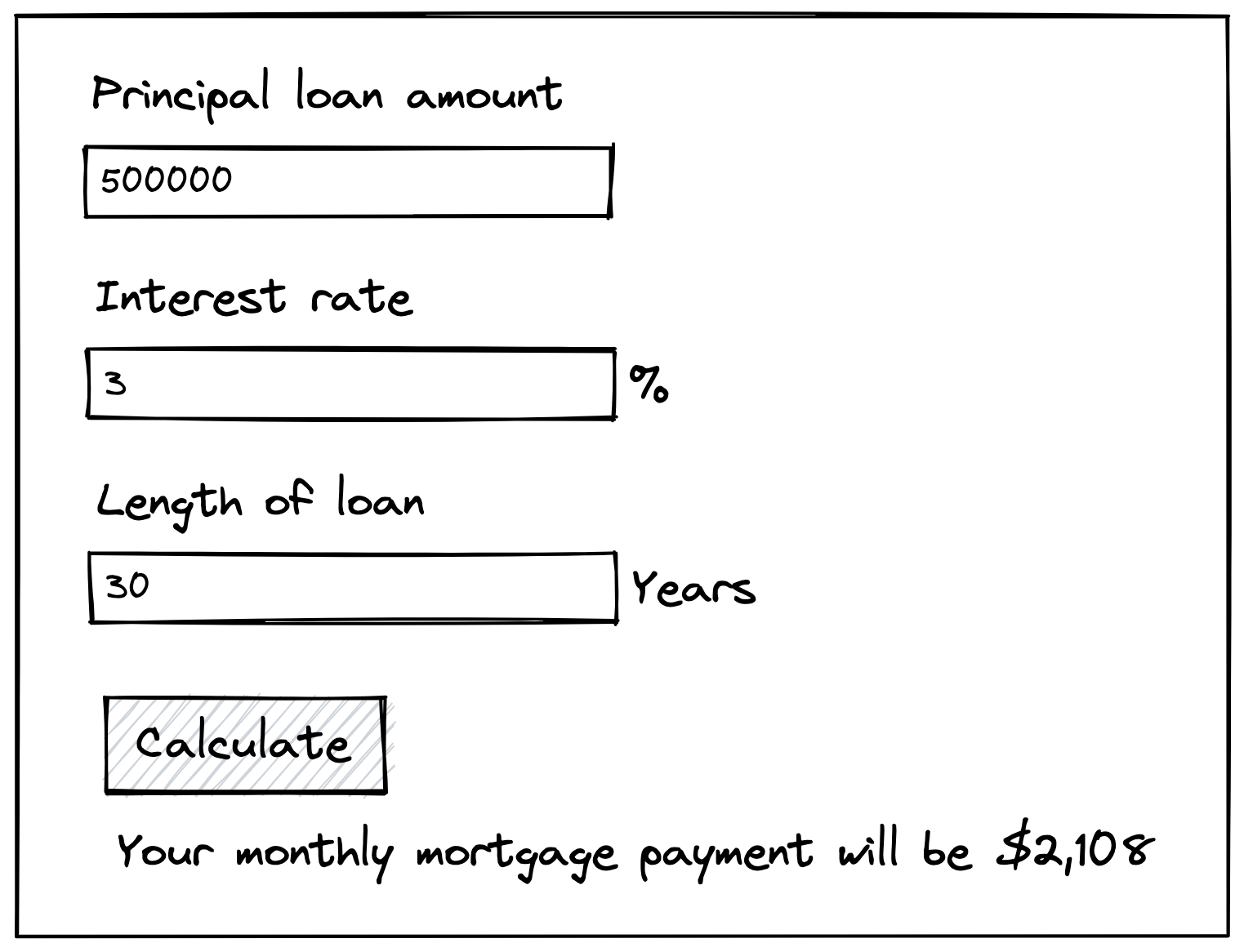

The main purpose of using a home loan calculator is to get a realistic, data-driven picture of how much you can expect to pay on a home loan. Most home loan companies give you pictures, but some include more options than others and are worth checking out. Start with the home loan calculator provided above to see if they can help you with your specific home loan needs.

Year And 15 Year Monthly Mortgage Payment Calculator And Amortization Schedule

Calculating the financial results of a change in one or more factors in a loan arrangement is called a loan calculation.

A mortgage calculator is a useful tool to determine how much you can afford to pay for a home before you buy. To see how much your monthly mortgage payments can change, play around with variables like mortgage rates and interest rates.

Buying a home will be the most important investment you will ever make. Before going house hunting, use a home loan calculator as a research tool. It will help you decide how much you can afford and how much house you can afford based on your monthly income.

Some loan calculator tools will even tell you how much money you will need to qualify for a loan. These estimates will help you determine if you can afford your desired mortgage. Knowing how much of your monthly home budget you can spend on your dream home is a wise and responsible first step toward your financial goals.

Loan Repayment Calculator: Personal Loans, Mortgages, Repayments

Look for a loan calculator that has the most responsibility and can do the extra math when looking for the best loan calculator. The more accurate the calculation is, the more specific inputs you want to provide.

Some mortgage calculator tools can calculate the loan amount when you enter the home purchase price, or they can calculate the home price when you enter the monthly payment. Taxes, PMI insurance rates, and how much pre-tax income you have to make are all factors that need to be included in the best mortgage calculator. This calculator will help you compare the cost of the loan that is paid in two weeks. payments and monthly loan payments. You can use this for any type of loan including home

How much mortgage will i qualify for calculator, mortgage calculator how much will i pay, pay mortgage faster calculator, how much total interest will i pay on my mortgage, how much interest will i pay calculator, mortgage calculator how much interest will i pay, how much interest will i pay on a mortgage calculator, mortgage pay calculator, how much mortgage will i pay, how much will i get pre approved for mortgage calculator, how much tax will pay calculator, how much faster will i pay off my mortgage calculator