What Mileage Can I Claim On My Taxes – Keeper is a delightful smart tax filing software that is very useful for those with 1099 contract and freelance income. Our blog breaks down IRS guidelines with real-world examples and analysis from tax professionals – empowering taxpayers to save money and take control of their finances.

Owning a car isn’t cheap, so this move can provide a significant source of tax relief. Let’s get in (driving?)!

What Mileage Can I Claim On My Taxes

You don’t have to be a rideshare driver or a self-employed travel seller to get car-related tax deductions. Even if you primarily work from a home office, the occasional supply run or client meeting downtown counts.

How To Claim Cra Approved Mileage Deductions In Canada

You don’t need to drive all year round. If you only drive to work during the summer, you can write off car expenses during those months.

What does that mean? For the IRS, “travel” is any vehicle you make between your home and a separate, dedicated workplace — such as an office or co-working space.

Having a tax-deductible home office means driving to and from work-related meetings and errands!

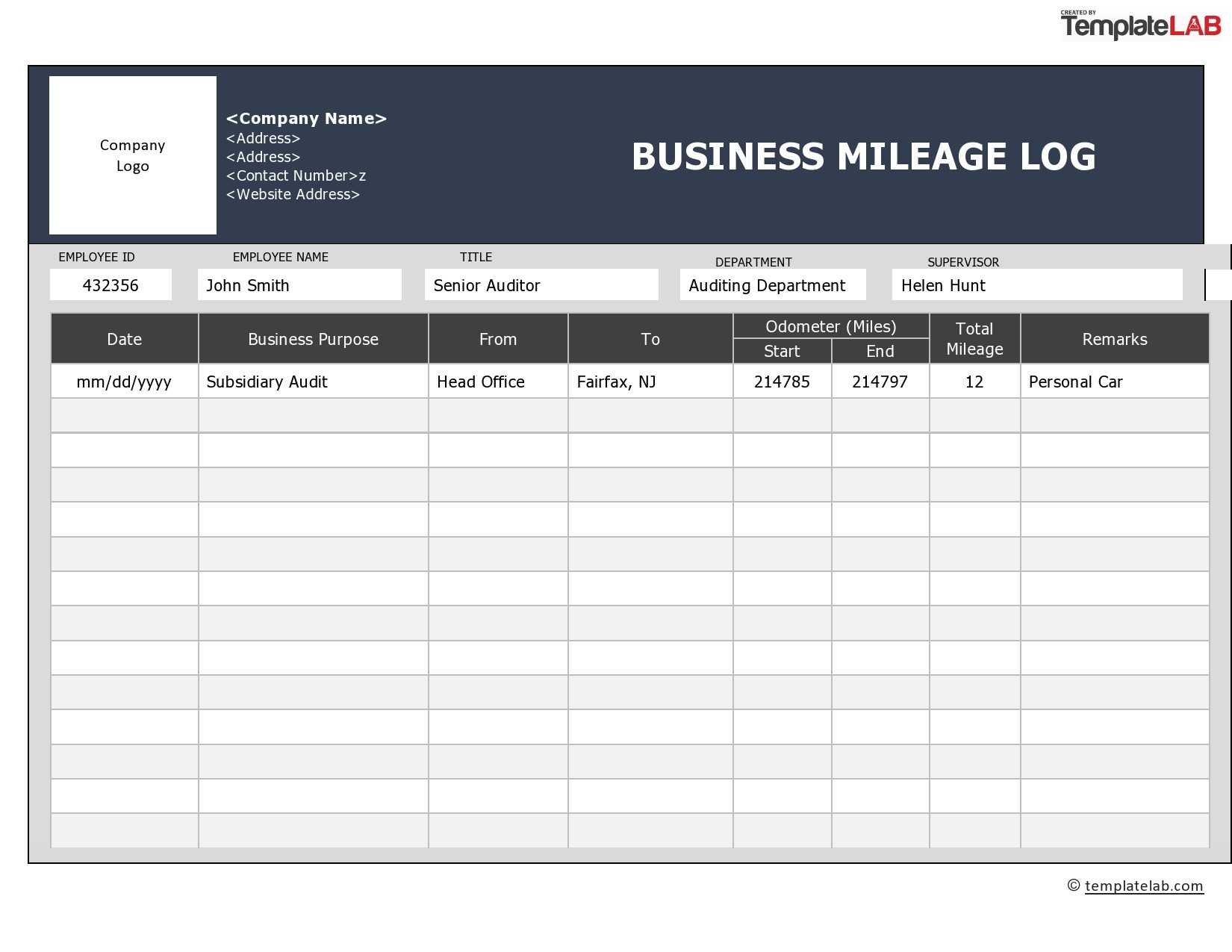

There are two ways to get car-related write-offs: keeping a mileage log or (easier, in our opinion) claiming a percentage of all your car expenses.

Deducting Mileage Versus Gas Receipts

With this method, you can track how many miles you drive to work. Then, you multiply each mile by a fixed amount determined by the IRS.

The rate changes every year. In 2022, there are actually two: $0.585 from January to June, then $0.625 from July to December. (The IRS wants to do something to acknowledge how high gas prices have gone!)

The IRS introduced this option in the late 90s. At the time, the aim was to simplify the registration process for tracking car expenses. In those days, you had to keep track of everything you spent on your car using something like a 1099 Excel template.

These days, modern apps (like Keeper!) allow you to automatically scan and categorize your credit card transactions. This creates a true costing system

What Miles Can Uber & Lyft Drivers Deduct On Taxes?

Instead of tracking every mile you drive, you can deduct just a percentage of your car-related expenses. This is called your “business-use percentage” — that is, how much you drive for work. You still need to keep notes that support the percentage, so many people use mileage trackers even when using the actual expense method.

Generally speaking, unless you’re a reckless driver or have a very old car, claiming genuine often results in a bigger tax break.

The actual math is complicated, and it depends on many different factors. See our detailed section for more examples.

There are two types of car expense write-offs: expenses you can deduct only through the actual expense method and expenses you can deduct

Can You Claim A Tax Deduction For Business Mileage?

If you finance your car, you can write off your own car payment. (This is called “depreciation”) You can write off a portion of the original cost of the car, even if you bought it a few years ago.

If you go with the actual cost method, you’ll need to determine your business usage percentage. To figure this out, you need to estimate how much of your driving mileage is “driving for work.” Don’t worry — it’s not an exact science.

For example, if you usually drop your kids off at school in the morning and use the car for work and meetings throughout the day, your business usage percentage might be 75%.

As with the mileage deduction, be sure to keep references and records to support your claim. Many people keep a mileage log no matter which method they choose.

Can I Deduct My Campground Fees As Business Expense On My Taxes As A Full Time Rver — Blog — Nuventure Cpa Llc

Most tax software isn’t built for you. is the keeper. We know every form you need and every deduction you can take to pay less this year.

At Keeper, we are on a mission to help people overcome the hassle of taxes. We have provided this information for educational purposes and do not constitute tax, legal or accounting advice. If you want a tax professional to clarify it for you, sign up for Keeper. You can also email support@ with your questions. To make sure you don’t submit your self-assessment tax return incorrectly, we’ve put together a guide on mileage allowance and how to claim it.

Mileage allowance is a tax-free allowance for self-employed people who use their vehicle for work. You can use it if you drive for business in a car, van or bike. The exact amount you can claim depends on how much you travel for business. You can claim mileage allowance through your annual self assessment tax return.

When you get the mileage allowance depends on whether you use your own car for business or bought your car to be a driver (for example, as an Uber or Hermes driver).

How Do I Submit Or Claim Mileage In Concur Expense…

If you bought your vehicle for the previous reason, it is in your best interest to claim mileage allowance. If you’re the latter, you can claim the true (and higher) value of your car. Basically, it makes sense to use:

You can claim it when you file your self assessment tax return. You must register for self-assessment with HMRC before the deadline to reclaim your expenses.

This should be done by 5th October every year. When actually declaring your expenses, fill in the relevant section of your self-assessment form.

If you are self-employed, you can calculate your vehicle expenses using a flat rate for mileage. This is in lieu of the actual costs of buying and running your vehicle, for example insurance, repairs, servicing, fuel. These are called simplified costs.

Best App To Log Mileage

Once you apply these flat rates to a vehicle, you must continue to do so as long as you use the vehicle for your business.

If you’re in full-time work and your employer only reimburses you 35p per mile, you can claim extra from HMRC. You do this by deducting your taxable income from your taxable income.

Check out our mileage allowance calculator to find out how much tax you’ll pay as a result!

If you’re self-employed and use your car for work, you can use the mileage allowance to claim back the fixed rate for your usage costs. If you are employed, claim the mileage tax credit instead. Claiming a mileage deduction is an important part of reducing taxes for anyone who owns a business or is self-employed and uses their vehicle for business. So, you may be wondering how the mileage deduction works?

Best Mileage And Expense Tracking Apps For 2023

You are welcome to use the above chart on your website. Remember to include a link to this article.

Share your mileage log with the IRS or your employer at the touch of a button. Try our mileage tracker app for free.

Mileage deductions may be taken by individuals who are self-employed, own businesses, and those in the armed forces, skilled workers, fee-based state or local government officials, and employees with disability-related work expenses. A mileage deduction can be taken for any business-related driving.

Those who drive for medical or charitable purposes can also claim a mileage deduction. But the rate is low, and requirements and limitations apply.

How Do Food Delivery Couriers Pay Taxes?

You must choose either the actual expense method or the standard mileage deduction method. However, the standard mileage rate should be used for the first year the car is in service.

If you have sufficient documentation, you can choose to calculate the deduction using both methods and choose whichever gives you the highest deduction.

The documents required depend on the method you are using. If you use the standard mileage deduction method, you will need your mileage log book. If you use your actual expenses, you will need receipts showing your expenses. However, you’ll want to track your mileage so you can see which method offers the highest deductible.

Now it’s time to see how to get mileage on taxes. If you are using the standard mileage deduction method, take the total business miles you logged for the year and multiply this by the standard mileage rate listed earlier.

Irs Standard Mileage Rate For Business Tax Deductions

If you use actual expenses, you add up all of your vehicle-related travel expenses for the year and multiply this number by the percentage the car is used for business or charitable purposes.

If you are a business owner or self-employed, you report your vehicle expenses on Schedule C, Part II, Line 9. This will be either the standard mileage deduction you calculate or the actual expenses.

You will also need to complete Part lV in which you will give some information about your vehicle:

You can fill out Schedule C on paper or online using IRS e-file or a professional tax service.

Working With Mileage

If you deduct mileage for medical purposes, the mileage deduction is deducted as part of your total unreimbursed medical expenses on Schedule A, line 1.

For charitable mileage deductions, you’ll use Schedule A, line 12.

What deductions can i claim on my taxes, when can you claim mileage on taxes, can i claim mileage on my taxes, can i claim mileage on taxes, can you claim mileage on your taxes, can you claim commute mileage on taxes, what can i claim on my taxes, who can claim mileage on taxes, what mileage can i claim on my taxes, can you claim mileage on taxes, can i claim gas and mileage on my taxes, claim mileage on taxes