How To Pay Taxes When Self Employed – Start your free trial, then enjoy 3 months for $1/month when you sign up for a monthly Basic or Starter plan.

Sign up for $1/month for 3 months and get $50 USD to use in the App Store. Terms apply. | Start a free trial

How To Pay Taxes When Self Employed

Try it for free and explore all the tools and services you need to start, run and grow your business.

Quickbooks Self Employed Pricing, Cost & Reviews

For full-time employees, taxes are usually out of sight, out of mind until the filing deadline rolls around every April. But for self-employed individuals—whether you have a part-time side gig, full-time freelance work, or a thriving small business—taxes are a regular part of managing your business and personal finances.

Without an employer automatically withholding taxes from your paycheck, it’s up to you to figure out your tax liability, including how much you owe, and when and how to pay. While some taxes will be familiar — like state or federal income taxes — working for yourself also comes with a whole new category to consider: self-employment taxes.

Self-employment tax, officially known as the Self-Employment Contributions Act (SECA) tax, is a required contribution from self-employed individuals to the federal government to fund Social Security and Medicare programs. You are considered self-employed if you are self-employed, a worker, independent contractor, sole proprietor or small business owner.

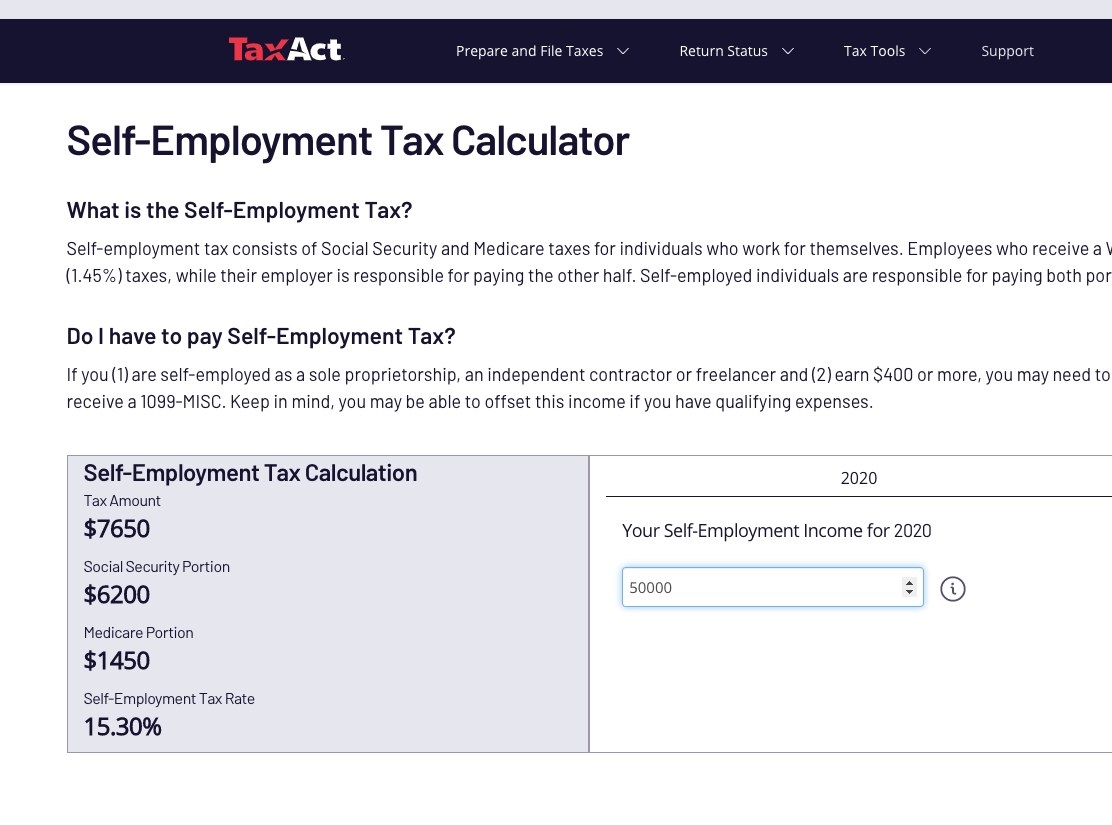

While full-time employees also pay Social Security taxes and Medicare taxes, they share the cost with employers as part of the Federal Insurance Contributions Act (FICA): Employees pay 6.2% of gross income to Social Security and 1.45% to Medicare in each paycheck. , and their employers match these percentages, for a total of 15.3%. However, those who are self-employed are responsible for the entire 15.3% tax rate: 12.4% to Social Security and 2.9% to Medicare.

Everything You Need To Know About Professional Tax In Andhra Pradesh

Anyone who earns $400 or more in self-employment income usually has to pay self-employment tax. You owe this tax on your net self-employment income (your income after your business expenses).

The tax is divided into two parts – Social Security and Medicare tax – and how much you pay for each part is calculated differently.

As of 2022, self-employed individuals owe 12.4% for Social Security on their first $147,000 of net earnings. If you earn more than $147,000 in a year, the rest of your earnings are not taxed for Social Security.

As of 2022, self-employed individuals pay 2.9% on their first $200,000 of net earnings for Medicare. (If you’re married, then you’ll pay 2.9% on the first $250,000 of combined self-employment income filed jointly, or $125,000 filed separately.) For earnings over $200,000 ($250,000 for married). filing together; $125,000 for those married filing separately), you will pay an additional 0.9% in Medicare taxes (meaning your tax rate increases to 3.8% for any income earned above the threshold).

Your Easy Guide To Self Employment Taxes

The United States has a “pay as you go” tax system, which means that people pay taxes as they earn money throughout the year. Employers withhold taxes from employees’ full-time wages and pay it to the government on their behalf. For the self-employed, however, it’s a bit more complicated.

If you expect to owe more than $1,000 annually in taxes, you are responsible for making estimated tax payments to the IRS each quarter by mail, online or through the IRS2Go app. These tax payments include both income tax and self-employment tax. At the end of the year, you will also file an annual tax return using Schedule SE (Form 1040) to report your self-employment taxes.

The quarterly deadlines for paying estimated taxes are April 15, June 15, September 15 and January 15 of the following year (unless one of those dates falls on a weekend or federal holiday, in which case the deadline is pushed to the next business day. ). If you don’t pay taxes by the due dates, you’ll owe an underpayment penalty fee when you file your taxes the following April. The penalty fee is calculated by the IRS based on the amount of the underpayment, the original due date, and their current interest rate for underpayments (6% starting October 1, 2022).

Self-employment tax often surprises people when they start working for themselves, because it’s more than they’re used to paying for Social Security and Medicare taxes. The good news is that although you are responsible for paying the entirety of these taxes, a portion of your payment is also tax deductible.

Everything You Need To Know About Paying Taxes On Your Side Gig

There are two ways self-employment tax works as a deduction. First, when you calculate how much self-employment tax you owe, you can reduce your net income by half the self-employment tax rate before you apply the tax.

For example, if you earn $100,000, you would theoretically owe $15,300 (15.3%) in self-employment tax. However, self-employed individuals are allowed to deduct half of that tax—the employer equivalent of the FICA tax rate (7.65%)—from their tax-eligible net earnings. Ultimately, this means that you only pay self-employment tax on 92.35% of your net income (in this example, $92,350) – amounting to $14,129.55 ($92,350 x 0.153).

Second, you can claim 50% of what you pay in self-employment taxes as a self-employment tax deduction on your income. In the above example, you could deduct your taxable income by $7,064.76.

These costs can be deducted from your self-employment income and lower your taxable income, reducing the amount of money you owe at the end of the tax year.

Credit Card Approval Guide For Self Employed Singaporeans

Self-employed individuals generally pay more in taxes. However, you are also allowed to deduct half of your self-employment tax, as well as eliminate personal and business tax deductions, to reduce your overall tax burden.

Start by estimating your net self-employment income. Next, calculate 92.35% of these earnings to calculate the self-employment tax deduction. As a general rule, you should set aside 15.3% of these reduced net earnings for paying self-employment tax.

Self-employment tax helps fund programs like Social Security taxes and Medicare taxes. While full-time employees also pay taxes to support these programs, they split the 15.3% tax rate with employers as part of the Federal Insurance Contributions Act (FICA). Self-employed individuals are responsible for both the employer and employee portion of these taxes.

You will soon start receiving free tips and resources. In the meantime, start building your store with a free 3-day trial of .

Tax Guide For Independent Contractors

Try free for 3 days, no credit card required. By entering your email, you agree to receive marketing emails from.Did you know that Freelancers and Self Employed are taxed differently (Singapore tax)? During the Singapore tax season (that’s coming), it can be increasingly frustrating for both freelancers and the self-employed if they need clarification on their tax obligations. This article will share the difference between freelancers and the self-employed and the methods of basic tax computation.

These two terms are often used interchangeably in Singapore, but they mean different things in one way or another. The most important difference between freelancers and freelancers is the freedom in their roles. In general, freelancers are always self-employed, but self-employed are not always independent.

Who is a freelancer? Freelancers work for different companies with different sets of tasks to perform on a short-term or contract basis and must fulfill their contractual obligations. A freelancer usually works for several clients and is not necessarily dedicated to one. One thing that also sets them apart from full-time employees is that they can choose which jobs they work on.

On the other hand, self-employed individuals can work in their premises and sell their ideas. Self-employed people are loyal to their businesses and customers buying their products or services. They earn a living by doing a business, profession or vocation. They are also considered sole proprietors and partners if they are registered with the Accounting and Corporate Regulatory Authority (ACRA).

These Self Employed Person (sep) Can Get $1k/mth For 9 Mths

Freelancers must pay taxes (for the business income they earn in a year. It will be considered business income, and it will be taxed according to individual income taxes.

You must pay income tax once your income exceeds $20,000 per year. However, you are exempt from paying taxes if you earn less. It means that if you receive an average income of ~$1800/month, you will have to pay income taxes to IRAS.

However, tax rates may vary depending on your tax residence. You will be treated as a tax resident for a particular YA if you are:

If it’s too complicated, you can go to the IRAS website for a Personal tax Calculator to calculate the amount of taxes you have to pay.

How To Pay Self Employment Tax (with Pictures)

Most businesses set their accounting period as the end of December, but as a freelancer, you can decide on the accounting period. At the end of the accounting period, you must prepare a Statement of Accounts that includes:

When preparing your Statement of Accounts, the information will be helpful for you to know whether your business is making a profit or a loss, and it will help facilitate the process of your tax payment. Depending on the income earned, you need to prepare a 2-line statement or a 4-line statement to file your Income Tax Return.

Second Line – Adjusted Profit For income earned over S$200,000, you should report your business on a 4-line statement:

![]()

Kelly provides consulting services and offers consultation to companies. He won S$80,000

Tax After Coronavirus

Self employed filing taxes, how to pay taxes when you are self employed, self employed how to pay taxes, do self employed pay taxes, self employed nanny taxes, how to pay less taxes self employed, self employed pay taxes, self employed payroll taxes, how to pay social security taxes when self employed, self employed pay quarterly taxes, self employed estimated taxes, how to pay taxes if self employed