Do You Have To Claim Life Insurance On Your Taxes – Life insurance is a contract between the life insurance company and the policy owner. A life insurance policy ensures that the policyholder pays one or more beneficiaries upon the death of the insured person in exchange for the lifetime benefits paid by the policyholder.

Many different types of life insurance are available to meet all needs and preferences. Depending on a person’s short-term or long-term insurance needs, the main options of choosing temporary or long-term life insurance are important to consider.

Do You Have To Claim Life Insurance On Your Taxes

Term life insurance is designed to last for several years, and then expire. You choose the term when you take out the policy. Typical terms are 10, 20, or 30 years. The best life insurance policies balance flexibility with long-term financial strength.

Crucial Guide For How To Increase 40% Life Insurance Claims

Many life insurance policies allow you to renew the policy every year after the term expires. This is a way to extend your life insurance coverage but since the renewal rate is based on your current age, the annual premium can be very high. A better solution for long term coverage is to convert your life insurance policy into a term policy. This is not an option in every life policy; look for a variable term policy if that’s important to you.

Term life insurance is valid for the lifetime of the policyholder unless the policyholder stops paying premiums or surrenders the policy. It costs more than the term.

When you buy insurance, you can start with a list of the best life insurance companies, some of which are listed below.

Term life insurance differs from term life insurance in many ways but tends to best serve the needs of most people looking for affordable life insurance coverage. Term life insurance lasts only for a specified period and pays a death benefit if the policyholder dies before the expiry of the term. Term life insurance is still valid as long as the policyholder pays the premium. Another big difference is the premium – life in general

How Long Do Beneficiaries Have To Claim Life Insurance?

Before you apply for life insurance, you should consider your financial situation and determine how much money is required to maintain the standard of living of your beneficiaries or meet your needs to purchase a policy. Also consider how long you will need coverage.

For example, if you are the primary caregiver and have a 2- and 4-year-old child, you need enough insurance to cover your responsibilities until your children are old enough to support themselves.

You can research the cost of hiring babysitters and housekeepers or using commercial child care and cleaning services, and may add money for education. Include all your spouse’s mortgage and annuity needs in your life insurance calculator. Especially if their salary is very low or their parents stay at home. Add up what you’ll spend in about 16 years, add more for inflation, and that’s the death benefit you might want to buy—if you can afford it.

:max_bytes(150000):strip_icc()/Life-Insurance-a8aee8e3024145a8b454ea19df030418.png?strip=all)

Funeral or final expense insurance is a type of long term life insurance that has a small death benefit. Despite the name, the beneficiaries can use the death benefit as they wish.

What Is The Chance Of Needing To Claim On A Life Insurance Policy?

Many factors can affect the cost of life insurance. Some things may be out of your control, but other conditions can be controlled to lower costs before (and after) implementation. Your health and age are the most important factors that determine the price, so buying life insurance as soon as you need it is often the best way to go.

After being approved for an insurance policy, if your health has improved and you have made positive lifestyle changes, you can request to consider changing your risk class. Even if you appear to be healthier than when you first signed up, your premiums will not increase. If you are found to be in good health, your premium may be reduced. You can also purchase additional coverage at a lower cost than the original.

Think about the expenses that will be incurred in the event of your death. Things like mortgages, college tuition, and other debts, not to mention funeral expenses. Additionally, income replacement is an important factor if your spouse or loved one needs money and cannot provide it on their own.

There are helpful tools on the Internet to calculate the total amount that can cover any expenses that may need to be covered.

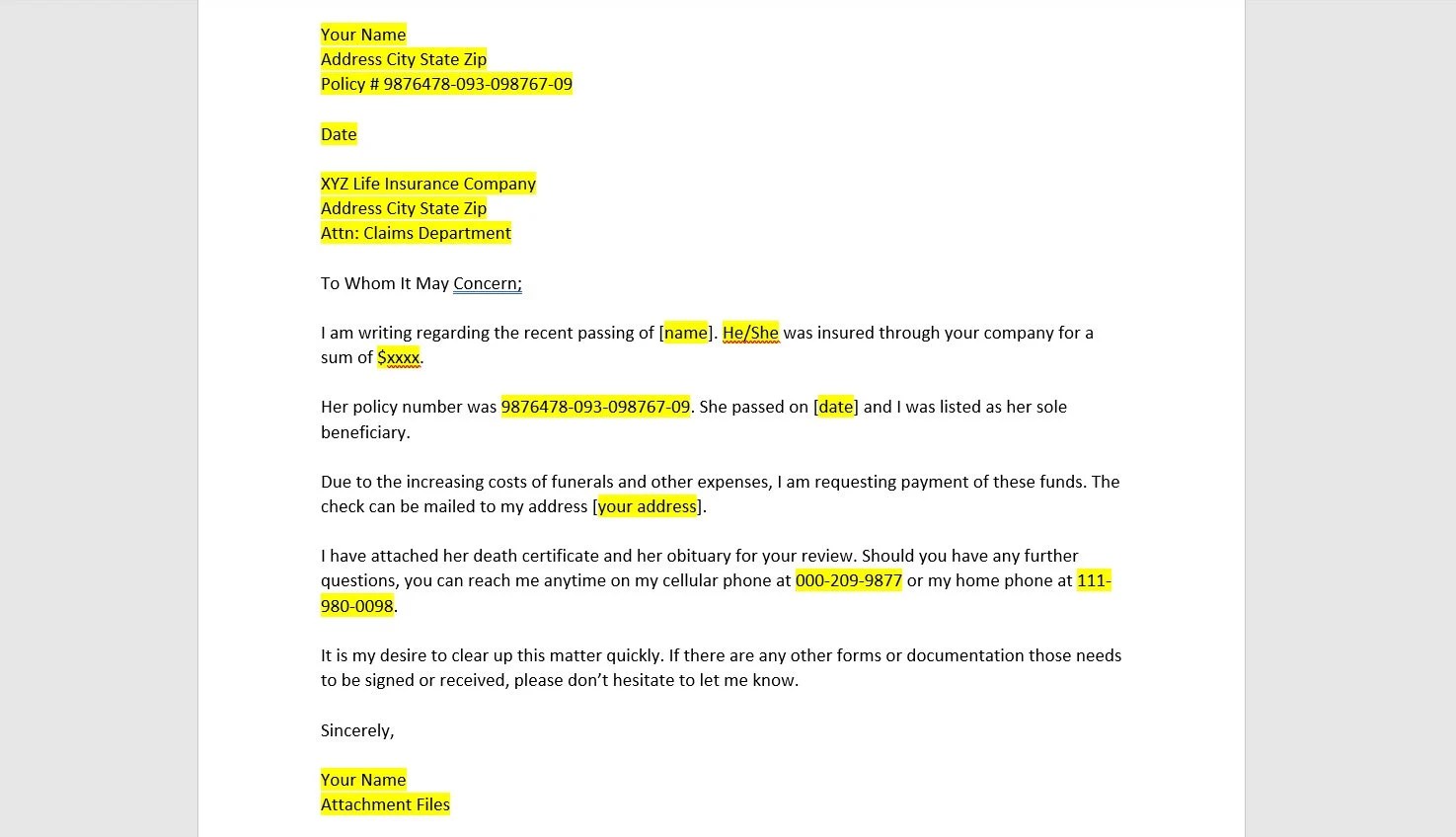

Death Insurance Claims

Life insurance applications generally require personal and family health history and beneficiary information. You may need to undergo a medical exam and need to disclose any pre-existing medical conditions, history of moving violations, DUIs, and dangerous hobbies, such as auto racing or skydiving. The following are important elements of most life insurance applications:

A standard form of identification is also required before writing a policy, such as a social security card, driver’s license, or US passport.

Once you have gathered all the information you need, you can collect many life insurance quotes from different providers based on your research. Prices can vary from company to company, so it’s important to make an effort to find the best combination of policies, company ratings and rates. Because life insurance is something you may pay monthly for decades, it can save you a lot of money to find the best policy that fits your needs.

Our ranking of the best life insurance companies can give you a quick start in your search. It lists the companies we’ve found to be the best for different types of needs, based on our research of nearly 100 carriers.

Types Of Death Not Covered By Term Insurance

There are many benefits to having life insurance. Below are some of the main features and protections that life insurance policies offer.

Most people use life insurance to provide money to beneficiaries who will experience financial hardship upon the death of the insured. However, for the wealthy, the tax advantages of life insurance, including capital growth, tax-free dividends and tax-free death benefits , can provide additional strategic opportunities.

Death benefits on life insurance policies are usually tax-free. Wealthy people sometimes buy long-term life insurance in a tax-deductible trust. This strategy helps to preserve the value of the property for the heirs.

Tax avoidance is a legal strategy for reducing tax liability and should not be confused with tax evasion, which is illegal.

Insurers Can Reject Policy Claim During The Contestability Period

Life insurance provides financial support to surviving dependents or other beneficiaries after the death of the policyholder. Here are some examples of people who may need life insurance:

Each policy is unique to the insured and the insured. It is important to review your policy documents to understand the risks your policy covers, how much it pays out to your beneficiaries, and under what circumstances.

Because a life insurance policy is a big expense and commitment, it’s important to do your due diligence to make sure the company you choose has a strong track record and financial strength, as it may not be profitable for the your heirs will be dead for decades to come. . has evaluated many companies that offer different types of insurance and has given the best in many categories.

Life insurance can be a smart financial tool to hedge your bets and provide protection for your loved ones in the event of your death if you die while the policy is still in effect. However, there are situations where it doesn’t make much sense — such as excess purchases or insurance that don’t need to be replaced by income. So it is very important to consider the following.

Demistifying Life Insurance

What expenses are not paid if you die? If your spouse has a high income and you don’t have children, it may not be safe. It is still important to consider the impact of your death on your spouse and think about how much financial support they will need to grieve without worrying about returning to work before they are ready. However, if a couple’s income is needed to maintain a desired lifestyle or meet financial commitments, the couple may need separate insurance coverage.

If you are buying a life policy for other family members, it is important to ask – what are you looking to insure? Children and the elderly do not have significant income to replace, but funeral expenses may be necessary in the event of death. In addition to funeral expenses, parents may want to protect their children’s future disability by purchasing a moderate policy at an early age. Doing so allows parents to ensure that their children can financially protect their future families. Only parents can purchase life insurance for their children up to 25% of the policy in force on their own life.

Would investing in term insurance premiums yield better returns over the course of a policy? As a hedge against uncertainty, regular savings and investments—for example, self-insurance—may make more sense in some situations if income does not need to be replaced. big

Do you have to claim student loans on taxes, can you claim life insurance on taxes, do you have to claim social security on your taxes, do you have to claim life insurance on taxes, do you have to claim workers comp on your taxes, how much do you have to make to claim taxes, do you have to claim personal injury settlements on your taxes, do you have to claim insurance claims on your taxes, do you have to claim alimony on taxes, do you have to claim a settlement on your taxes, do you have to claim inheritance money on your taxes, do you have to claim workers comp on taxes